Creating a Personalized Payroll Dashboard – Key Metrics and Effective Strategies

Managing payroll is crucial, for any business impacting aspects such as employee satisfaction and financial health. A crafted payroll dashboard offers real time insights into payroll expenses, compliance and employee salaries streamlining the management of these processes for HR and finance teams. In this article we will delve into the metrics to monitor in a payroll dashboard practices for its development and tips on crafting customized templates using Excel and Google Sheets.

Getting Acquainted with Payroll Dashboards

Understanding the Concept of a Payroll Dashboard

A payroll dashboard serves as a centralized aid that consolidates payroll metrics into an easily digestible format. It presents an up to date overview of payroll data enabling HR and finance experts to track performance indicators, like payroll outlays, employee remuneration, tax adherence and more. By visualizing this information companies can make choices, spot trends. Ensure smooth running payroll operations.

Key Metrics to Monitor in a Payroll Dashboard

Managing Payroll Expenses and Budgeting

One of the roles of a payroll dashboard is. Controlling payroll expenditures.

Keeping track of payroll costs overtime expenses and the specific details of benefits and deductions is essential. These factors play a role, in budgeting and financial planning enabling companies to manage their payroll spending.

Total Payroll Costs

The amount spent on employee compensation, which includes salaries, bonuses and benefits is a measure for understanding the overall labor expenses of a company. This information is vital for planning and budgeting purposes.

Overtime Expenses

Monitoring overtime costs is important as it can have an impact on the budget allocated for payroll. By tracking these expenses businesses can identify patterns such as departments requiring overtime work. This insight may lead to adjustments in staffing or scheduling practices to mitigate these costs.

Breakdown of Benefits and Deductions

Understanding how benefits and deductions contribute to payroll costs is essential for cost management. This includes factors like health insurance coverage, retirement savings contributions and various employee perks along with deductions like taxes and social security payments. A detailed breakdown of these elements helps in overseeing compensation expenditures while ensuring processing of all contributions and deductions.

Employee Compensation Analysis

Analyzing employee compensation metrics provides insights into payment structures within an organization. These metrics are instrumental, in promoting compensation practices across all levels of employment and pinpointing areas where salary adjustments may be necessary.

Calculating the salary, per employee enables HR and finance teams to keep an eye on compensation trends and compare them to industry norms. This measure helps ensure that the company stays competitive in attracting and retaining talent.

Wage Growth and Trend

Observing wage growth and trends over time is crucial for budgeting and financial planning. It allows businesses to forecast payroll costs accurately and ensures that salary increases are in line with company performance and industry benchmarks.

Compliance

Maintaining compliance with labor laws and tax regulations is an aspect of payroll management. A payroll dashboard should feature metrics that promote accuracy and compliance reducing the chances of facing issues or financial penalties.

Tax Withholding

Ensuring tax withholding is essential for complying with state regulations. A payroll dashboard should monitor tax withholding rates to guarantee they are correctly applied to each employees pay, preventing issues like under or over withholding that could result in compliance problems or discontent among employees.

Tracking Payroll Errors

Tracking the rate of payroll errors is important as errors can be expensive and time consuming to rectify. By monitoring this metric businesses can. Resolve issues in their payroll processes minimizing the risk of mistakes that may lead to compliance breaches or dissatisfaction, among employees.

Top Recommendations, for Constructing a Tailored Payroll Dashboard

Defining Your Payroll Goals

Prior to developing a payroll dashboard it is crucial to establish the goals you aim to accomplish. This entails aligning the dashboard with the business objectives of the company and recognizing the individuals who will utilize it.

Aligning the Dashboard with Company Objectives

Developing a payroll dashboard necessitates aligning it with the business objectives of the company. For instance if the aim is to lower labor expenses the dashboard should emphasize metrics concerning payroll costs and overtime. Integrating the best pay stub generator can further enhance the dashboard by ensuring accurate tracking and reporting of payroll data. By ensuring alignment with business goals you can guarantee that it offers insights, for making decisions.

Recognizing Key Stakeholders and Their Requirements

Various stakeholders may have varying requirements when it comes to payroll information. Human resources professionals might concentrate on employee pay and compliance statistics while financial teams may give priority to budget management and expense regulation. Identifying these stakeholders and comprehending their needs will assist in designing a dashboard that meets all users demands.

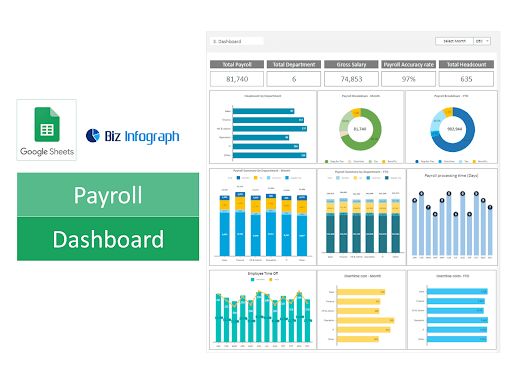

Payroll Dashboard Samples

Biz Infograph offers payroll dashboard templates both in Microsoft Excel an Google Sheets.

Excel based Payroll Dashboard Template

Excel provides a lot of flexibility and a wide variety of features that make it perfect for designing a dashboard tailored to your requirements.

Benefits of Using Excel, for Payroll Dashboards

Excel is widely utilized and offers customization options making it a great option for creating a payroll dashboard. It enables users to design formulas, pivot tables and charts equipping them with the tools to monitor and analyze payroll data effectively. Moreover Excel provides the freedom to craft a dashboard that suits the needs of your company.

Essential Components of an Excel Payroll Dashboard Template

A designed Excel payroll dashboard template should encompass components like automated calculations, data validation, as well as visual elements such as charts and graphs. These elements simplify monitoring payroll metrics ensuring data precision and visualizing patterns over time.

Step by Step Instructions for Constructing a Payroll Dashboard in Excel

When building a payroll dashboard in Excel begin by identifying the metrics you wish to monitor. Then establish your data sources. Create the required formulas for calculating these metrics. Utilize pivot tables and charts to organize and visualize the information effectively. Lastly personalize the layout to emphasize details and guarantee user navigation, on the dashboard.

Creating a Payroll Dashboard Template using Google Sheets

Google Sheets provides a cloud based option to Excel, offering the convenience of real time collaboration, alongside features.

In Summary

Developing a payroll dashboard necessitates preparation and precision. By monitoring indicators like payroll expenditure, staff remuneration, adherence to regulations and attendance records organizations can extract insights into their payroll operations. Utilizing platforms such, as Excel and Google Sheets enables the creation of a tailored dashboard that caters to the requirements of your company.