Is a Reverse Mortgage Safe? What You Need to Know

Reverse mortgages can be a helpful financial tool for retirees looking to supplement their income, but many people wonder about their safety and reliability.

If you’re considering a reverse mortgage, it’s essential to understand how they work, their benefits, and potential risks.

This blog will cover everything you need to know to determine if a reverse mortgage is a safe option for you obtained from best reverse mortgage lenders.

How Does a Reverse Mortgage Work?

Reverse mortgages provide funds based on the value of your home, your age, and current interest rates. You can receive the money as a lump sum, monthly payments, a line of credit, or a combination of these options. The loan balance increases over time as interest and fees accrue, but you don’t have to make monthly mortgage payments.

Benefits of a Reverse Mortgage

- No Monthly Payments: You don’t have to make monthly mortgage payments, which can help ease your financial burden.

- Stay in Your Home: You can continue living in your home while accessing its equity.

- Flexible Disbursement: Receive the funds as a lump sum, monthly payments, or a line of credit, depending on your needs.

- Non-Recourse Loan: You or your heirs won’t owe more than the home’s value when the loan is repaid, even if the loan balance exceeds the home’s value.

Safety Considerations

- Government-Insured Loans: Most reverse mortgages are Home Equity Conversion Mortgages (HECMs), insured by the Federal Housing Administration (FHA). This insurance provides protection against lender default and ensures you won’t owe more than your home’s value.

- Mandatory Counseling: Before obtaining a reverse mortgage, you must attend counseling with a HUD-approved counselor. This ensures you understand the loan terms, costs, and alternatives.

- Regulated Fees: The government regulates HECM fees, which helps prevent excessive costs. However, it’s still essential to understand all fees involved.

Potential Risks

- Reverse mortgages come with interest and fees, which can add up over time and reduce your home equity.

- The loan must be repaid when you leave the home, which may reduce the inheritance for your heirs.

- You’re still responsible for property taxes, homeowners insurance, and home maintenance. Failure to meet these obligations can result in foreclosure.

- If your financial situation changes and you need to move, sell your home, or require long-term care, a reverse mortgage may complicate your plans.

Who Should Consider a Reverse Mortgage?

Homeowners with Significant Equity

If you have substantial home equity, a reverse mortgage can provide significant funds.

Those Needing Additional Income

If you need extra income to cover living expenses or healthcare costs, a reverse mortgage can be a helpful solution.

Homeowners Planning to Stay Long-Term

If you plan to stay in your home for many years, a reverse mortgage can be a good way to access your equity.

Tips for Ensuring Safety

- Research Lenders: Choose a reputable lender with experience in reverse mortgages. Check their credentials and read reviews.

- Understand the Terms: Make sure you fully understand the loan terms, including interest rates, fees, and repayment conditions.

- Consult a Financial Advisor: A financial advisor can help you evaluate whether a reverse mortgage is the best option for your situation.

- Consider Alternatives: Explore other options, such as home equity loans or downsizing, to see if they better meet your needs.

Legal and Financial Protections with Reverse Mortgages

When considering a reverse mortgage, it’s crucial to understand the legal and financial safeguards in place. Here are some key protections:

- Mandatory Counseling: Federal regulations mandate counseling before signing a reverse mortgage agreement. This ensures borrowers fully comprehend the financial implications, terms, and potential risks involved.

- Loan Structure: Reverse mortgages are structured to prevent borrowers from owing more than the home’s appraised value when it’s sold. This protection extends to borrowers’ heirs, safeguarding against potential debt exceeding the property’s worth.

- FHA Insurance: The Home Equity Conversion Mortgage (HECM), the most common type of reverse mortgage, is insured by the Federal Housing Administration (FHA). This insurance provides an additional layer of financial security by guaranteeing loan repayment to lenders, even if the home value declines.

These safeguards aim to protect borrowers from predatory practices, ensuring transparency and fairness throughout the reverse mortgage process. Understanding these protections is essential for making an informed decision about whether a reverse mortgage aligns with your financial goals and retirement plans.

Steps to Take Before Committing to a Reverse Mortgage

Before committing to a reverse mortgage, several steps can help you make an informed decision:

- Research Types of Reverse Mortgages: Understand the differences between Home Equity Conversion Mortgages (HECMs) and proprietary reverse mortgages offered by private lenders.

- Consult with a HUD-Approved Counselor: These counselors provide unbiased information about reverse mortgages, helping you navigate the complexities and assess suitability.

- Evaluate Your Financial Situation: Consider your current income, expenses, and retirement plans to determine if a reverse mortgage fits your financial goals.

- Assess Long-Term Goals: Think about how a reverse mortgage aligns with your plans for staying in your home or moving in the future.

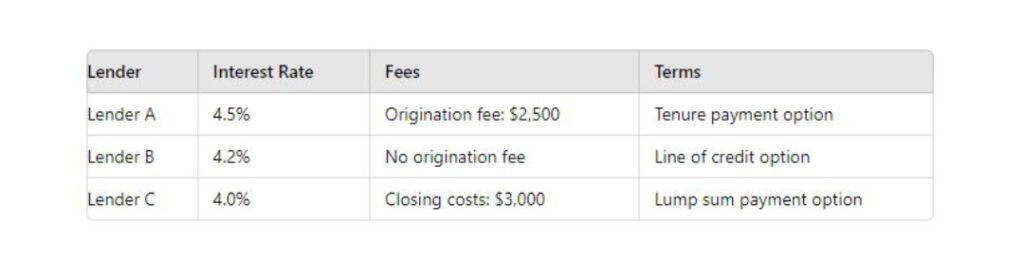

- Compare Offers: Request quotes from multiple lenders to compare interest rates, fees, and terms. Use a table to compare these factors:

- Discuss with Family and Advisors: Seek input from trusted family members or financial advisors to ensure you fully understand the implications and make the best decision for your financial future.

Last Words

A reverse mortgage offers a viable option for tapping into home equity, but it’s crucial to approach it with awareness of its implications. Selecting a trustworthy lender, completing required counseling, and seeking advice from financial experts are pivotal steps in ensuring a well-informed choice. Understanding the terms, risks, and costs associated with different types of reverse mortgages empowers you to weigh the benefits against potential drawbacks effectively.

Moreover, thoughtful planning aligns this financial tool with your retirement goals, potentially enhancing financial security and lifestyle flexibility. By taking these precautions and leveraging professional guidance, you can navigate the complexities of a reverse mortgage with confidence, making it a potentially beneficial component of your retirement strategy.